In the complex landscape of tax and financial documentation, the terms “Form W-9” and “Substitute Form W-9” often surface, each serving distinct but occasionally confusing roles. This blog is your compass to navigate through the differences between the standard Form W-9 and its custom counterpart, the Substitute Form W-9. We will explain their specific purposes and clarify when to use each form, offering you a comprehensive understanding of these essential documents.

What is the Purpose of Form W-9?

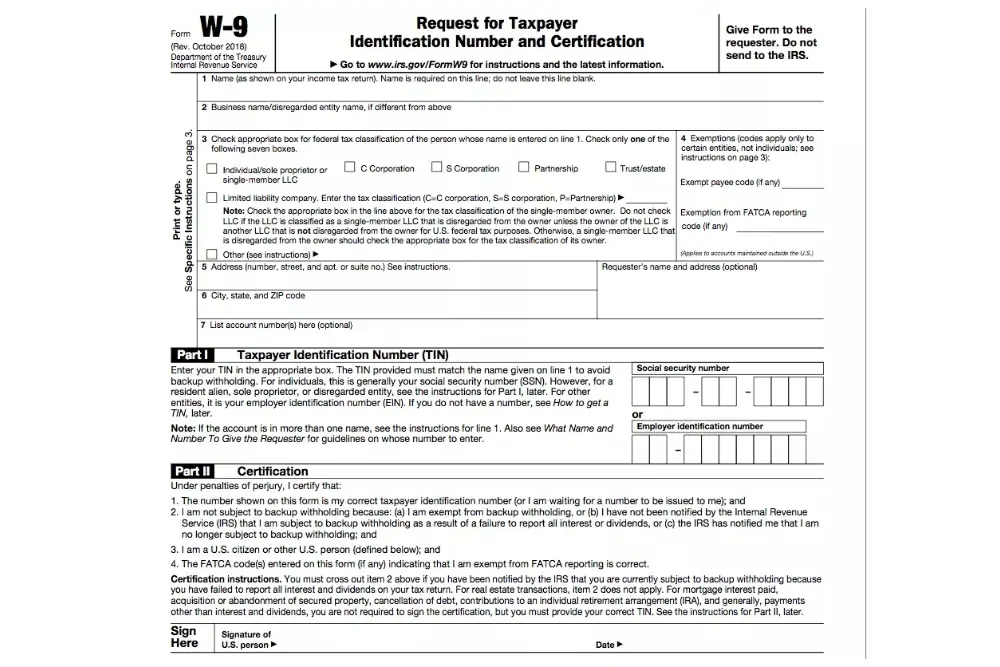

Let’s start by understanding the Form W-9 form. A Form W-9 is a standard tax form used in the United States to collect essential information from individuals or entities, such as independent contractors, freelancers, or vendors, who receive payments.

The purpose of the Form W-9 is to provide the requester, often the paying entity, with the recipient’s taxpayer identification number (TIN), which can be a Social Security Number (SSN) or an Employer Identification Number (EIN). This information is crucial for the requester to report payments to the Internal Revenue Service (IRS).

Let’s Understand Its Purpose With An Example:

To comprehend the significance of the Form W-9 form, consider a scenario involving a freelance graphic designer, Ashley, and a small digital marketing agency, CS Solutions Inc.

Ashley is an independent contractor who provides her design services to CS Solutions Inc. In this business relationship, CS Solutions Inc. is the paying entity, while Ashley is the recipient of payments for her design work.

To ensure compliance with tax regulations, CS Solutions Inc. requires Ashley to complete a Form W-9 form. The Form W-9 collects key information, including Ashley’s taxpayer identification number (TIN), which, in her case, is her Social Security Number (SSN). Ashley enters this information on the Form W-9.

Now, Here’s Why The Form W-9 Is Crucial In This Context:

- Reporting to the IRS: CS Solutions Inc. must report the total payments it makes to Ashley for her design services to the Internal Revenue Service (IRS) at the end of the tax year.

- Verification of Recipient: The Form W-9 serves as a formal declaration by Ashley that the TIN provided is accurate and corresponds to her. This information helps the IRS verify her tax records.

- Avoiding Backup Withholding: If Ashley provides an incorrect TIN or fails to complete the Form W-9, CS Solutions Inc. might be required to withhold a portion of her payments for tax purposes, known as backup withholding. The Form W-9 allows her to avoid this withholding if her information is accurate.

In this example, the Form W-9 acts as a bridge between the freelance worker and the business, ensuring that payments are correctly reported to the IRS and that the recipient’s tax responsibilities are met. It’s a fundamental component of financial transparency and compliance in such business arrangements.

Why Substitute W-9 Form is required?

Now, let’s explore the Substitute Form W-9. Unlike the standard Form W-9, a Substitute Form W-9 is not an official IRS form. Instead, it is a document created by the requesting party, such as a company or organization, to gather the same essential taxpayer information as a Form W-9. Substitute Form W-9s are used when the requester has developed their own form that serves the same purpose as the official IRS Form W-9.

Let’s understand Its Purpose with an Example:

Consider a regional event planning company, Glow Events, which frequently hires local musicians to perform at their events. For tax and payment purposes, Glow Events requires musicians to provide their taxpayer information. Instead of using the standard IRS Form W-9 form, Glow Events has created a custom Substitute W-9 form to meet its specific event management needs.

In this Scenario:

- The Event Planning Company: Glow Events has created a Substitute Form W-9 form, which includes specific fields for the musicians to fill in their legal names, taxpayer identification numbers (TIN), contact details, and the type of services they offer. This customized form streamlines the data collection process.

- The Musicians: Local musicians, like Jenny and Jake, who are scheduled to perform at Glow Events’ functions, receive the company’s Substitute Form W-9 forms. These forms request the same essential taxpayer information as the official IRS Form W-9, ensuring that payments are accurately reported to the IRS.

- Purpose: The Substitute Form W-9, designed by Glow Events, serves the same fundamental purpose as the standard IRS Form W-9. It allows the company to collect the necessary taxpayer details from the musicians to accurately report payments, while also streamlining the process according to their specific event management requirements.

- Tax Reporting: When Glow Events needs to report payments to the IRS, it uses the taxpayer information gathered through the Substitute Form W-9 to complete required forms, such as Form 1099, which reports income paid to independent contractors and other service providers.

In this example, the Substitute Form W-9 created by Glow Events simplifies and customizes the information-gathering process for the company, making it more efficient for their unique business needs. It showcases how a Substitute Form W-9 can be tailored to suit the particular requirements of an organization, streamlining tax-related procedures.

Key Differences Between W-9 and Substitute W-9

To provide a clear comparison between the two forms, here’s a breakdown of the differences:

| Aspect | Form W-9 | Substitute Form W-9 |

| Issuer | IRS (official form) | Requesting party (custom) |

| Layout and Formatting | The official W-9 has a standardized layout and format as provided by the IRS. | The layout and formatting of substitute forms may vary depending on the organization using them, but they should still include the required information. |

| Customization | The official W-9 form cannot be customized or altered by the requesting party. | Substitute forms allow some degree of customization to suit the specific needs and preferences of the requesting entity. |

| Legal Status | Official IRS document | Not an official IRS form |

| Purpose | Used to collect TIN for IRS reporting | Customized form for the same purpose |

| Acceptance | Widely accepted by all entities | Acceptance may vary depending on the requester |

| Form Distribution | Can be obtained from the IRS website | Provided by the requesting party |

| Filing Deadline | N/A | Set by the requester |

| Use Cases | The official W-9 is used for a wide range of tax-reporting purposes, including payments to freelancers, independent contractors, and vendors. | Substitute forms are primarily used by specific organizations, such as banks or companies, for their internal record-keeping and reporting needs. |

Common Mistakes of W-9 & Substitute Form W-9 and How to Avoid Them

These two documents are important but can be confusing when considered separately. Despite their importance, errors in filling out these forms are surprisingly common. Here are some of the most frequent mistakes or errors of these forms and how to avoid them:

1. Providing Incorrect Information:

Error: One of the most common mistakes when filling out these forms is giving wrong information like your name, address, or tax ID number (TIN).

Avoidance: Double-check all details before submitting the form. Ensure that the information matches exactly what is on file with the IRS to prevent processing delays or potential penalties.

2. Missing or Incomplete Form:

Error: Sometimes, individuals or entities need to fill out all required sections of the W-9 or Substitute Form W-9.

Avoidance: Carefully review the form instructions and ensure that all fields relevant to your situation are completed accurately. Fill in any important blank field to avoid processing issues.

3. Failure to Sign:

Error: Forgetting to sign the form is another common mistake which often results in delays or complications in form processing.

Avoidance: Before submitting the form, double-check the fields where a signature is needed and sign it.

4. Using Outdated Forms:

Error: Using an outdated version of the W-9 or Substitute Form W-9 may lead to discrepancies or rejection.

Avoidance: Get the latest form from the IRS website or authorized sources. Check for updates regularly to follow the current rules. Sometimes, things not needed in the old form are necessary in the new one.

5. Misunderstanding Tax Classification:

Error: Picking the wrong tax category, like ignoring if you’re a business or saying the wrong type of business is another common mistake.

Avoidance: Learn about the different tax categories and what they mean. If you’re not sure, ask a tax expert to help you figure out which category fits your situation best. This will help you avoid making mistakes.

6. Ignoring Backup Withholding Requirements:

Error: Not following the IRS rules for backup withholding when they tell you to.

Avoidance: Watch for any notices or instructions about backup withholding. Be sure to provide correct information to avoid facing backup withholding.

7. Overlooking Updates or Changes:

Error: Failing to update information on file, such as changes in name, address, or TIN.

Avoidance: Check and update your info regularly. Tell the right people quickly if anything changes to avoid problems with future transactions.

Conclusion

Understanding the distinctions between the Form W-9 and the Substitute Form W-9 is essential in the realm of tax and financial documentation. The standard Form W-9, issued by the IRS, serves as a universal tool for collecting taxpayer information, crucial for reporting payments to the IRS. On the other hand, the Substitute Form W-9, crafted by the requesting party, offers customization to streamline data collection while serving the same fundamental purpose. These differences highlight the importance of selecting the right form based on specific business needs, ensuring compliance with tax regulations and efficient tax-related processes. Whether it’s the official Form W-9 or a customized Substitute Form W-9, both play a vital role in maintaining financial transparency and adherence to tax regulations.