The Google Sheets payroll template is a cloud-based and pre-designed document that assists payroll professionals, employers, and companies in efficiently organizing, calculating, and monitoring employees’ payroll data and essential information needed for seamless payroll processing.

Companies use Google Sheets to conveniently record, organize, and calculate payroll-related details, including taxes, overtime pay, and deductions. Creating columns, rows, adding formulas and functions, and formatting manually in Google Sheets is time-consuming and susceptible to errors. In contrast, Google Sheets offers preformatted payroll templates. Users simply fill in the necessary data in the appropriate rows and columns. Most importantly, these templates are both free and customizable. This empowers the user to add new columns, apply formatting, and include formulas or functions as needed.

You can input details like employee names, pay period and date, total work hours, gross pay, taxes, net pay, etc. All you need to do is input the data in the appropriate fields, and the template will record and calculate these entries using the formulas, functions, and formatting specified in the template. For example, to deduct taxes from an employee’s salary, all the user has to do is input the tax percentage, and the system will calculate the tax for each employee falling in the corresponding tax bracket.

These 5 Google Sheet templates will help payroll professionals run a smooth payroll process:

1. Google Sheet Template for Payroll Register

Running the payroll process smoothly goes beyond just giving salaries to the employees; it involves meticulous record keeping even after the wages have been paid and it is done because for taxation purposes.

And it can be done with the help of the Google Sheet template which is a very good tool that collects comprehensive information about your employees’ earnings and pay periods.

You can input all the necessary information, and the template will automatically compute additional values accurately. This template includes columns for the following details:

- Hourly wage rates

- Pay period (dates of commencement, conclusion, and payment)

- Employee names

- Gross earnings

- Net pay

- Total hours worked

- Medicare deductions

- State and federal taxes

- Social security contributions

- Insurance deductions

- Aggregate withholdings

The following are some reasons why you should use the Google Sheets Payroll Register Template:

1. Effortlessly track your workforce’s weekly, monthly, and yearly earnings, deductions, work hours, and remuneration dates.

2. Yearly tax filing and provision of payroll tax reports are imperative for business operations. The Payroll Register Template streamlines the recording of essential data required for tax submissions and reporting.

3. Estimating wage budgets is facilitated through the use of payroll register templates.4. Utilize the compiled data to create wage reports and annual W2 forms for each individual staff member.

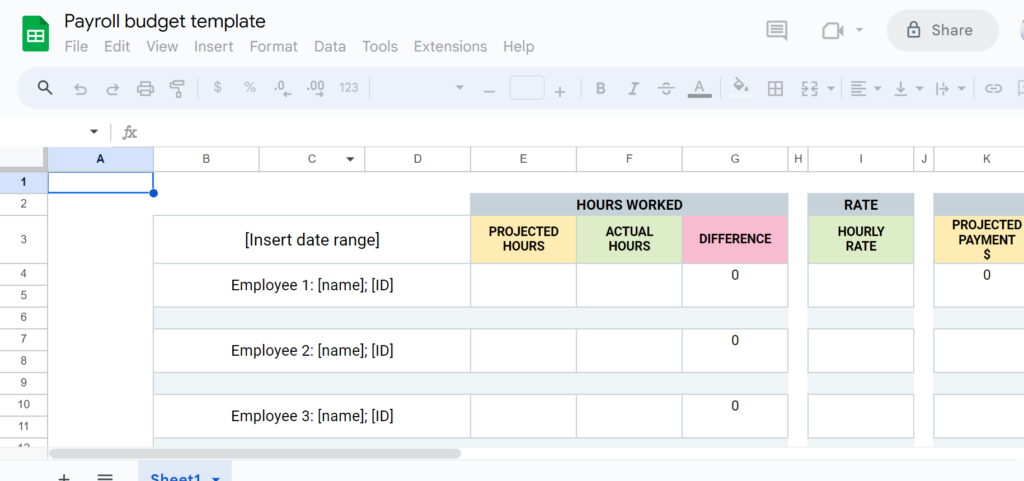

2. Google Sheet Template for Payroll Budget

Payroll management stands as a crucial financial pillar for every business. The failure to accurately estimate payroll expenses increases the risk of overspending and financial losses. To ensure seamless operations, the creation of a carefully designed payroll budget emerges as essential. This is where the Google Sheets Payroll Budget Template emerges as an indispensable tool.

The user can use the template and use its capabilities efficiently to strategize and oversee your payroll budget. Throughout the strategic planning process, this resource becomes an essential companion for businesses.

To utilize the template, users need to choose their preferred budget calculation period—whether it’s monthly, quarterly, or annually—within the template. They can then input employee details, hourly rates, and projected work hours into the template. Once this information is entered, the template will automatically generate an estimated budget customized to their requirements.

Benefits of Using the Google Sheets Payroll Budget Template:

1. Precisely allocate your budget to different departments within your company.2. This template holds special significance when you’re in the process of staff expansion or making crucial financial choices like employee salary adjustments and benefits enhancements.

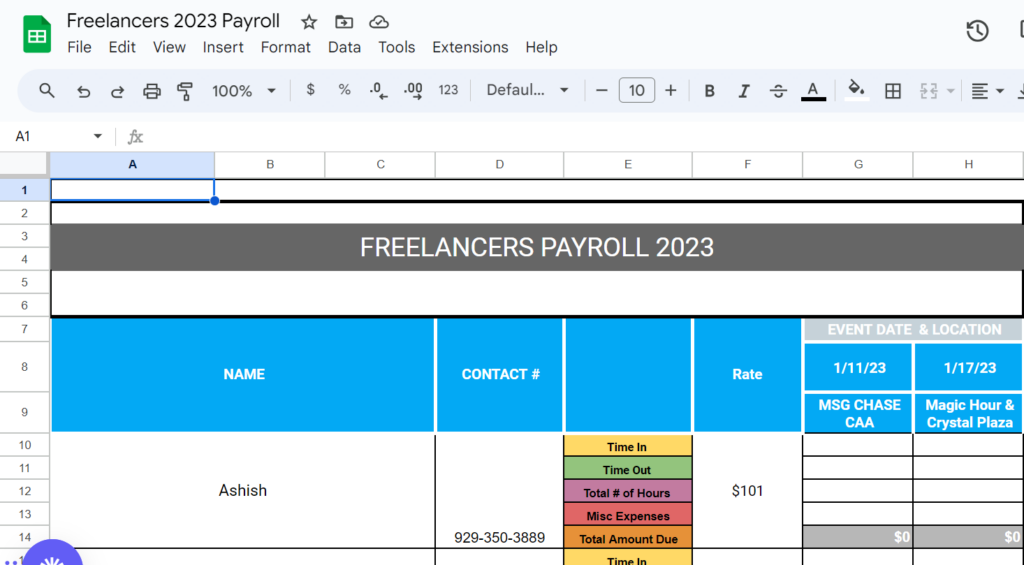

3. Google Sheet Template for Monthly Payroll

Many companies choose to compensate their employees on a monthly basis, adhering to a specific payment date. Timely payroll distribution is crucial for maintaining a positive company reputation. However, providing paychecks punctually is not a simple task, as it involves handling various intricate variables that can be challenging to manually calculate. And it becomes more difficult if a company hires many freelancers to perform various tasks for the company in a month. For example, a graphic design company hires multiple freelance graphic designers to work on the numerous projects they receive from various clients.

This is where the Google Sheets Monthly Payroll Template comes in to assist both payroll professionals and companies in keeping records, tracking, and ensuring timely payment of employees’ and freelancers’ paychecks. By offering an efficient and automated solution, this template simplifies the complex process of monthly payroll calculations.

It streamlines the giving of the payroll process by automatically calculating essential elements for each employee’s monthly pay. It encompasses net monthly income, total work hours (including regular and overtime hours, as well as PTO hours), taxation, and gross pay.

Google Sheets Monthly Payroll Template: Why Use It?

1. Flexibility is a key feature. Adjust the template to fit your business needs. Some companies calculate pay using regular hours only, while others include PTO and taxes.

2. The cost of processing is notably low because you only manage payroll calculations 12 times a year. This method ensures efficiency while controlling costs.

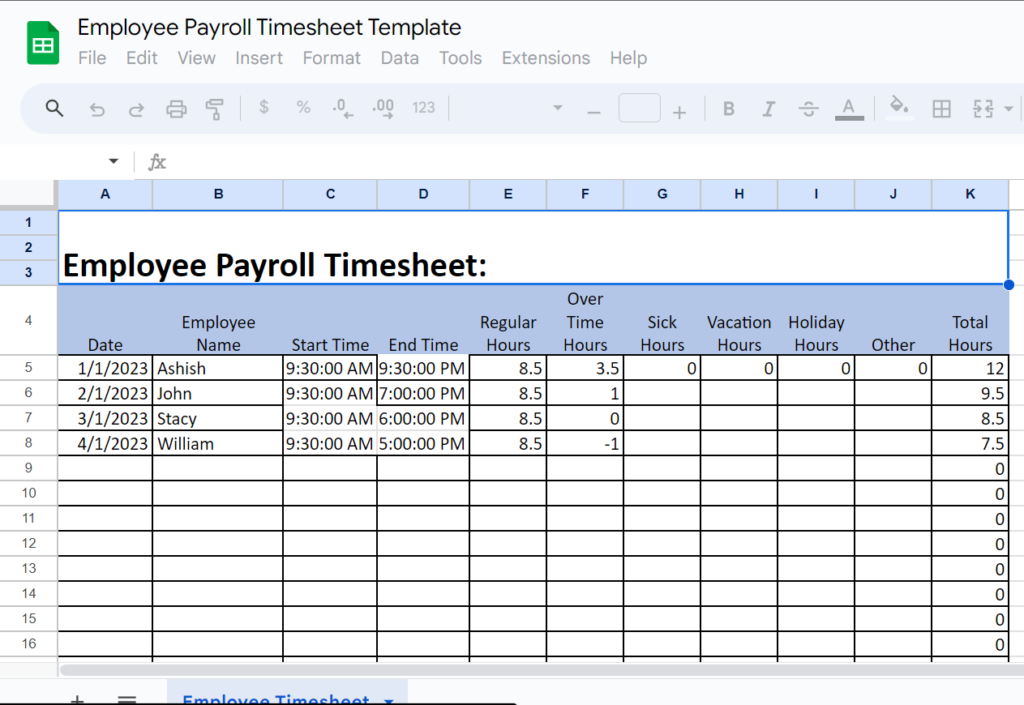

4. Google Sheet Template for Payroll Timesheet

Tracking employees’ work hours, whether in-office or remote and leaves is crucial for accurate pay calculation. In the absence of a proper time tracking system, the Google Sheets Payroll Timesheet Template offers a solution.

This template assists payroll professionals in tracking and calculating employee work hours. Employees can record clock-ins and clock-outs for each task. It facilitates calculating regular work hours, overtime, and holiday work hours.

In Google Sheets, there are five types of payroll timesheet templates:

- Daily Timesheet Templates

- Weekly Timesheet Templates

- Biweekly Timesheet Templates

- Monthly Timesheet Templates

- Project Timesheet Templates

- Customize a template to match your company’s needs.

Reasons to choose Google Sheets Payroll Timesheet Templates:

- You can say goodbye to expensive and complex time-tracking tools when you use these sheets.

- Using these Google Sheets Timesheet Templates is both free and user-friendly.

- Due to the fact that these sheets record the data for you, you don’t have to worry about losing work-hour records.

- Your data in timesheets is secure and accessible anywhere because they are based on the cloud system.

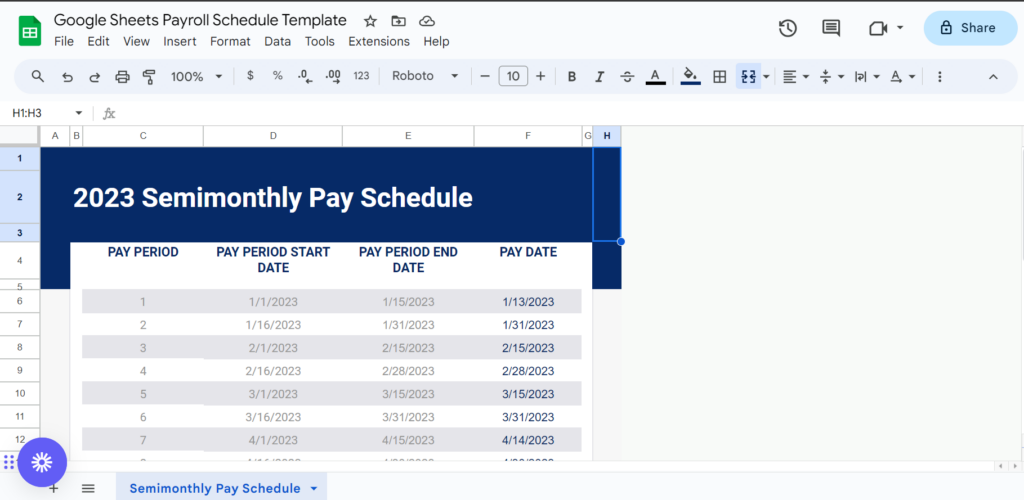

6. Google Sheet Template for Payroll Schedule

Wondering how to maintain employee satisfaction? The answer is simple: timely payments. Ensuring your employees are paid promptly requires an effective payment system. There’s a solution that fits perfectly, and that’s Google Sheets Payroll Schedule Template.

The template is designed to establish your employee payment schedule. If you require timesheet submissions from employees, this template can also serve as a reminder for submission deadlines – just like an early-morning alarm.

There are four payroll schedule templates to choose from:

- Monthly

- Semimonthly

- Biweekly

- Weekly

Or You can select the schedule that aligns with your business requirements.

Key details covered by Payroll Schedule Templates:

- Payroll period

- Pay period start date

- Pay period end date

- Pay date

To utilize the provided templates effectively, begin by understanding the purpose of each column. Then, input the relevant payroll information into the corresponding cells. This approach ensures accurate recording, tracking, and calculation of crucial payroll elements, contributing to the efficient processing of payroll tasks.

Conclusion

Incorporating digital tools like Google Sheets templates can simplify and streamline your payroll management. With tailored solutions for payroll registers, budgets, monthly payroll, timesheets, and schedules, you’ll effortlessly handle complex calculations and stay organized. Embrace these templates to enhance accuracy, save time, and ensure timely payments for a seamless payroll process.