The American dream is a beacon of hope for countless individuals, both born in the United States and those who see it as a land of boundless opportunities from afar. In pursuit of this dream, people work diligently to secure good jobs, start their own businesses, and create the life they envision. The allure of the American dream is a magnetic force that transcends borders, attracting immigrants from around the world in search of jobs and opportunities.

While the pursuit of the American dream knows no boundaries, U.S. employers, too, play a pivotal role in this journey. They offer the opportunities that immigrants seek, creating a symbiotic relationship that fuels the nation’s growth. To ensure this relationship is built on a solid foundation, employers must navigate the complex terrain of immigration compliance. Central to this compliance is the I-9 form, a document that verifies an employee’s identity and eligibility to work in the United States.

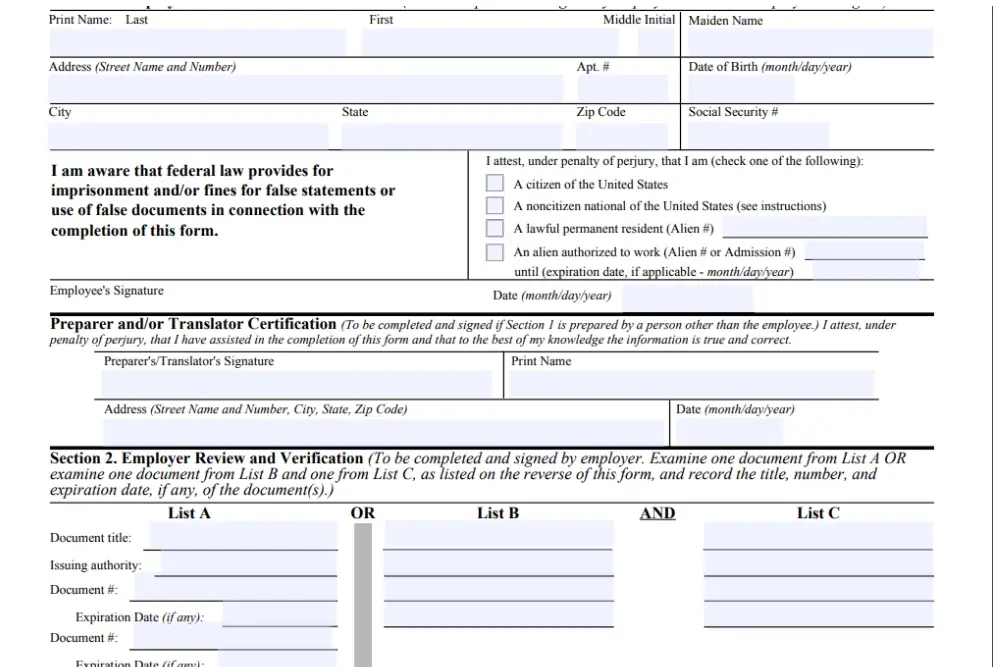

Smartly emphasizing the importance of the I-9 form, it serves as a guardian against hiring undocumented or illegal workers. This document holds the key to preventing labor violations and safeguarding the interests of both employees and employers. Employers are required to maintain completed I-9 forms for each employee, making them accessible for inspection by government agencies if necessary.

However, in this blog, we’ll dive into the common errors that employers often make in the I-9 process, errors that should be avoided to ensure a seamless and legally compliant hiring process.

10 Common I-9 Errors Employers Need to Avoid:

- Incomplete Forms: Neglecting mandatory fields is one of the most common yet avoidable mistakes made by some employers. When filling out an I-9 form, it is crucial to ensure that all required fields are accurately completed. Leaving any sections blank is a compliance violation and can result in potential issues.

- Mistakes in Employee Information: It’s imperative to maintain accuracy in employee details, including their name, birthdate, and Social Security number. Errors in these crucial pieces of information can potentially result in compliance issues. Therefore, employers should exercise exceptional attention to detail to prevent such mistakes from occurring.

- Failure to Sign and Date: Both the employee and employer must sign and date the I-9 form. An unsigned form can result in penalties. Make sure everyone involved in the form acknowledges it.

- Document Selection Errors: The I-9 form specifies acceptable documents for verification. Choosing the wrong documents, using expired ones, or presenting documents not listed on the form can lead to complications. Always check the list of acceptable documents to avoid this mistake.

- Late Completion: Employers must complete Section 2 of the I-9 form within three business days of the employee’s start date. Failing to do so is a common violation. Ensure the form is completed promptly. It is a common mistake on the I-9 form made by employers.

- Mismatched Documents: Accuracy in an employee’s information, such as their name, birthdate, and Social Security number, is critical on the I-9 form. Errors can lead to compliance problems. Attention to detail here is essential.

- Mandatory Retention of I-9 Forms: Employers are legally obligated to retain I-9 forms for a specific period, as outlined on the form itself. Failure to do so can result in penalties and complications during audits. Keeping the forms on file is a fundamental compliance requirement.

- Not Re-verifying When Required: When an employee’s work authorization or immigration status has an expiration date, employers must re-verify and update the I-9 form as necessary, as indicated on the form. Failure to do so can result in compliance issues.

- Relying Solely on Electronic Signatures: While electronic signatures are allowed, it’s important to remember that the physical I-9 form must still be completed, signed, and retained in accordance with the instructions on the form. Both electronic and physical records should be part of the process.

- Failing to Monitor Visa Expirations: Employers should actively monitor employee visa expirations, which is relevant to the I-9 process. Staying aware of these dates helps ensure continued compliance with the form.

Conclusion

The pursuit of the American dream is a shared journey, where individuals and U.S. employers come together in the quest for boundless opportunities. The I-9 form plays a pivotal role in this endeavor, ensuring that the hiring process remains legally compliant and guards against the employment of undocumented or illegal workers. It serves as a cornerstone for both employers and employees, safeguarding their interests and preventing labor violations.

However, to maintain this solid foundation, employers must be vigilant and avoid the common errors we’ve discussed in the I-9 process. By paying attention to detail, completing forms in a timely manner, and ensuring the accuracy of information, employers can contribute to a seamless and legally compliant hiring process. These efforts not only benefit the employer but also foster a stronger, more compliant workforce, ultimately enhancing the pursuit of the American dream for all involved.

Avoiding these common I-9 errors is not just about compliance; it’s about upholding the spirit of opportunity and aspiration that continues to draw people to the land of endless possibilities. In doing so, employers and employees can create a more secure and promising future together.