Throughout history, we’ve been making tools to help us with everyday tasks. It started with stone tools in ancient times and moved on to the printing press in the 14th century. Then, computers came around in the 20th century, and now in the 21st century, we have advanced technologies like ChatGPT.

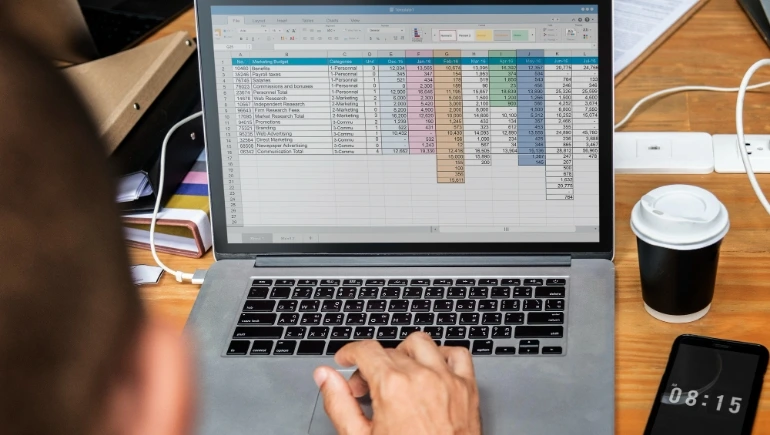

Modern-day computers have evolved beyond mere machines; they have transformed into versatile platforms that house a multitude of indispensable tools. Among these tools, Excel stands out as exceptionally valuable. It serves as a pivotal resource for a wide array of businesses, facilitating the organization of data, intricate mathematical computations, and the visual representation of information. Essentially, Excel acts as a cornerstone for streamlining operations, ensuring smoother workflows.

Excel’s capabilities extend to precise calculations, such as determining total salaries by factoring in deductions like tax withholdings and incorporating additional components like overtime pay. This dynamic tool empowers businesses to enhance accuracy, optimize data management, and create a more efficient operational environment.

In this blog, we will cover five essential Excel features that hold great importance and practicality, knowledge of which is invaluable for every payroll professional.

Here are the five Excel features:

- Pivot Tables: This Excel feature holds significant power, aiding users in swiftly and effortlessly analyzing and summarizing extensive data sets. In large corporations as well as medium-sized enterprises, payroll-related information is in large quantity. Pivot tables play a crucial role by offering valuable insights into data trends, patterns, discrepancies, and comparisons. These insights are pivotal for payroll professionals to accurately monitor expenses and labor costs. With the pivot table feature, payroll experts can effortlessly transform intricate payroll data into meaningful insights, simplifying the data analysis process.

- VLOOKUP and HLOOKUP features: In Excel, there are two features known as VLOOKUP and HLOOKUP that prove highly beneficial for locating specific data sets within spreadsheets. VLOOKUP serves the purpose of seeking values within columns and subsequently returning corresponding values from other columns. For instance, if you have various columns encompassing employee names, salaries, IDs, and tax information, a VLOOKUP search for ‘John’ would reveal both his name and salary, IDs and other information.HLOOKUP, on the other hand, performs the same task but horizontally or across rows. This function proves particularly advantageous for cross-referencing employee IDs, pay rates, and tax details. For payroll professionals, this capability is instrumental in ensuring precise compensation calculations. HLOOKUP, on the other hand, performs the same task but horizontally or across rows. This function proves particularly advantageous for cross-referencing employee IDs, pay rates, and tax details. For payroll professionals, this capability is instrumental in ensuring precise compensation calculations.

- Conditional Formatting feature: It is a feature that assists payroll professionals in identifying inconsistencies within payroll data. Through various rules within conditional formatting, specific irregularities can be pinpointed. For example, rules can be established to highlight duplicate entries, signal overdue payments, or detect disparities in working hours. By utilizing such rules, payroll professionals can swiftly recognize and rectify discrepancies. This tool guarantees timely detection and resolution of errors prior to payroll processing, leading to reduced errors and fewer delays.

- Data Validation: Through the utilization of this feature, payroll professionals can establish precise criteria for entering payroll data. Given the crucial role data plays, any inaccuracies can ripple throughout associated calculations and outcomes. By employing this functionality, payroll professionals can define ranges for salary figures, hours worked, and tax rates. This proactive approach substantially reduces the likelihood of errors that could otherwise result in inaccurate calculations.

- Formulas and Functions: Excel offers numerous formulas (which you can create with the help of symbols) and built-in functions that assist payroll professionals in automating accurate complex calculations, as long as the formula execution and data accuracy are ensured. Predefined formulas or functions like SUM, AVERAGE, COUNT, MIN, DCOUNT, and IF can be utilized for tasks such as calculating total compensation, performing conditional calculations and average salaries. Formulas, composed of rows, columns, cells, and symbols, are customizable to suit specific payroll needs, ensuring efficient and reliable accurate calculations.

Conclusion

As payroll professionals navigate the dynamic landscape of modern work, utilizing the power of Excel and its features becomes essential. Pivot Tables empower data-driven decisions, VLOOKUP and HLOOKUP ensure precision in data retrieval, Conditional Formatting reveals errors for prompt resolution, Data Validation ensures data accuracy and Formulas and Functions automate intricate calculations. These tools collectively form a robust toolkit, enabling payroll experts to streamline processes, enhance accuracy, and contribute significantly to organizational success. For this very reason, payroll professionals should familiarize themselves with these functions and acquire a strong understanding of Excel.