Amidst the flurry of tax season, employers find themselves navigating the intricate terrain of Form W-2, a cornerstone document that delineates employee earnings and deductions. As we delve into the updates for 2024, it’s essential to stay abreast of the latest changes to ensure seamless compliance. From deadlines to key revisions, this comprehensive guide unpacks everything employers need to know about Form W-2. So, let’s embark on a journey of enlightenment, uncovering the nuances and essential insights to streamline your tax filing process. Buckle up as we delve into the world of Form W-2 and equip ourselves with the knowledge to navigate through tax season with confidence!

Deadline Reminder

The deadline for distributing Forms W-2 to employees and filing them electronically with the Social Security Administration (SSA) has already passed. It was January 31, 2024.

Revised W-2 Forms

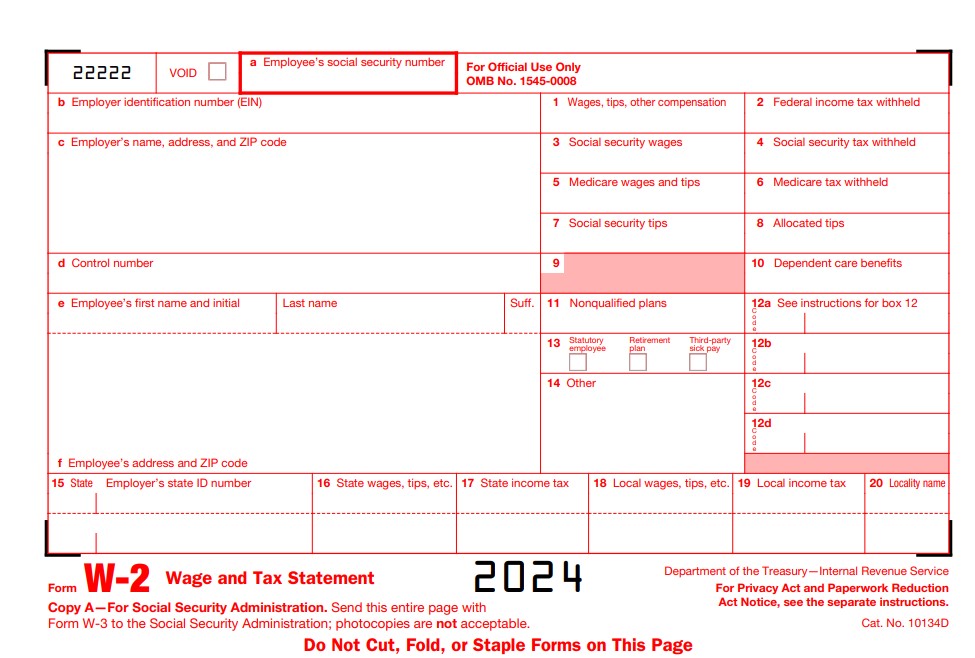

In January 2024, a slight revision was made to the previously published 2024 Forms W-2, W-2AS, W-2GU, and W-2VI. The modification pertains to Box 12, Code S, where the text under “Instructions for Employee” was amended to remove “(not included in box 1)”. Employers should ensure they are using the updated versions when filing.

Key Updates for 2024

- Pension-linked Emergency Savings Accounts: The SECURE 2.0 Act has introduced new “emergency savings accounts” within defined contribution plans. Employee contributions to these accounts, alongside any other designated Roth contributions, must be reported in Box 12 of Form W-2.

- State and Local Wage Withholding: Minor updates have been made to specific state and local wage withholding codes in Box 15 and subsequent boxes. Employers are advised to refer to the IRS instructions for detailed information pertaining to their respective state or locality.

- Third-Party Sick Pay Reporting: If third-party sick pay payments were made to employees (e.g., through an insurance company), employers should report the taxable amount in Box 14 and use code “Z.” Additionally, include the total amount (taxable and non-taxable) in Box 1 for informational purposes.

Additional IRS Resources

These resources will help you learn more about the W-2 form, updates, and everything you need to know as an employer.

- IRS General Instructions for Forms W-2 and W-3 (2024)

- Changes to the Previously Posted 2024 Forms W-2, W-2AS, W-2GU, and W-2VI

- Tax Season 2024: Here’s What to Do If You Haven’t Received Your W-2 Yet

Tips for Smooth Filing of Forms W-2

Should specific questions arise regarding your situation, it’s advisable to consult a tax professional or visit the IRS website for guidance. Before filing Forms W-2 electronically or on paper, it’s essential to double-check all information for accuracy. Additionally, maintaining copies of all Forms W-2 for record-keeping purposes is crucial. By staying informed and ensuring accurate and timely filing of Forms W-2, employers can contribute to a seamless tax season for both themselves and their employees.

Conclusion

Staying up-to-date with Form W-2 updates is vital for employers to navigate tax season smoothly. Remember, the deadline for distributing Forms W-2 has passed, and it’s crucial to use the revised versions for accurate filing. Key updates for 2024, such as pension-linked emergency savings accounts and state/local wage withholding, require careful attention. Utilize IRS resources for further guidance, and consult a tax professional if needed. By following these tips and ensuring accurate filing, employers can contribute to a seamless tax season for themselves and their employees. Stay informed, stay compliant, and make tax season a breeze!