The Form W-4, Employee’s Withholding Certificate, is a vital document used by employees to inform their employers of the amount of federal income tax to withhold from their paychecks. In recent years, significant changes have been made to the W-4 form, including the introduction of a redesigned layout and new withholding methods.

In this comprehensive guide, we’ll explore how to use the new Form W-4, including the various new tables, to ensure accurate tax withholding and compliance with IRS regulations.

Understanding the Changes to the Form W-4:

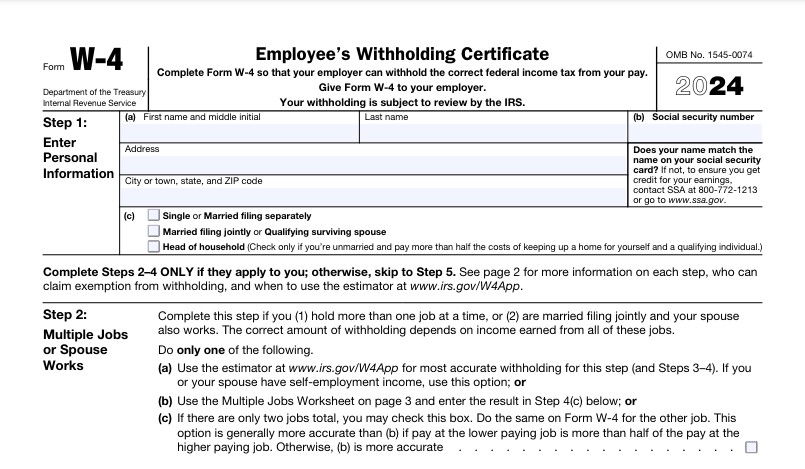

The IRS introduced a redesigned Form W-4 in 2020, aimed at simplifying the withholding process and aligning it more closely with the Tax Cuts and Jobs Act (TCJA) enacted in 2017. The new form 2024 with minor changes eliminates withholding allowances and instead requires employees to provide specific information about their filing status, income, deductions, and credits. Additionally, the form includes optional fields for additional income, deductions, and extra withholding amounts.

Key Steps to Completing the New Form W-4:

To effectively use the new Form W-4, employees should follow these key steps:

- Provide Personal Information:

- Start by providing your personal information, including your name, address, Social Security number, and filing status. The filing status you choose will determine the tax brackets and standard deduction amounts used to calculate your withholding.

- Determine Multiple Jobs or Spouse Works:

- If you have multiple jobs or if your spouse works, you may need to adjust your withholding to account for additional income. Use the Multiple Jobs Worksheet or the Two-Earners/Multiple Jobs Worksheet provided with the form to calculate the appropriate withholding allowances.

- Claim Dependents and Other Tax Credits:

- Indicate the number of dependents you have and any other tax credits you are eligible for, such as the Child Tax Credit or the Credit for Other Dependents. Use the Deductions, Adjustments, and Additional Income Worksheet to calculate these amounts accurately.

- Provide Additional Information:

- If you have additional income, deductions, or extra withholding amounts you would like to account for, provide this information in the appropriate sections of the form. This will help ensure that your withholding is adjusted correctly based on your specific financial situation.

- Review and Sign the Form:

- Before submitting the Form W-4 to your employer, carefully review all information to ensure accuracy. Once complete, sign and date the form to certify that the information provided is true and correct.

Using the New Withholding Tables:

In addition to the redesigned Form W-4, the IRS introduced new withholding tables to assist employers in calculating federal income tax withholding amounts. These tables are based on the information provided by employees on their W-4 forms and take into account factors such as filing status, income, and tax credits.

There are several withholding tables available, including the Percentage Method Tables for Automated Payroll Systems, the Wage Bracket Method Tables, and the Percentage Method Tables for Manual Payroll Systems. Employers use these tables to determine the appropriate amount of federal income tax to withhold from employees’ paychecks based on their wages and other relevant factors.

It’s essential for employees to understand that the withholding tables are designed to provide a general estimate of the amount of tax to withhold and may not reflect individual circumstances accurately. Therefore, it’s crucial to review your withholding periodically and make adjustments as needed to ensure that you are withholding the correct amount of tax.

Tips for Maximizing Tax Withholding Efficiency:

To make the most of the new Form W-4 and withholding tables, consider the following tips:

- Use the IRS Tax Withholding Estimator:

- The IRS offers a Tax Withholding Estimator tool on its website, which allows you to calculate your withholding allowances based on your specific financial situation. Use this tool to estimate your tax liability and adjust your withholding accordingly.

- Review Your Withholding Annually:

- Tax laws and personal circumstances can change from year to year, so it’s essential to review your withholding annually and make any necessary adjustments. Life events such as marriage, divorce, birth of a child, or change in employment status can all impact your tax withholding requirements.

- Seek Professional Advice if Needed:

- If you’re unsure about how to complete the Form W-4 or adjust your withholding, consider seeking advice from a tax professional. They can help you navigate the process and ensure that you are withholding the correct amount of tax based on your individual circumstances.

Conclusion:

Navigating the new Form W-4 and withholding tables may seem daunting at first, but with a clear understanding of the process and careful attention to detail, employees can ensure accurate tax withholding and compliance with IRS regulations. By providing accurate information on the Form W-4 and reviewing withholding periodically, employees can optimize their tax withholding efficiency and avoid any surprises come tax time.