Navigating the dynamic landscape of payroll software options can be a daunting task, especially when seeking the perfect fit for your business. In the ever-evolving world of 2024, where efficiency and adaptability are paramount, we present a comprehensive comparison of the top three payroll software solutions: Gusto, OnPay, and Intuit QuickBooks Payroll.

Whether you’re a small startup or a growing enterprise, this guide aims to simplify your decision-making and payroll process by delving into the unique features, pricing structures, and pros and cons of each, allowing you to make an informed choice tailored to your specific needs.

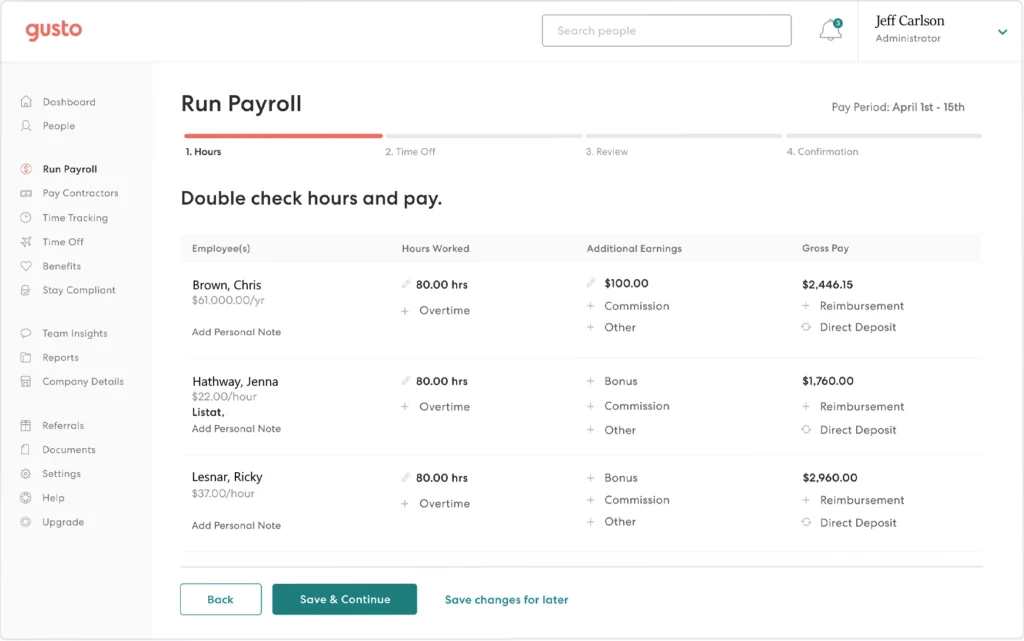

1. Gusto: Your All-in-One HR Powerhouse

Gusto is designed to accommodate businesses of different sizes, this software places a special focus on delivering comprehensive HR solutions that extend beyond the conventional offerings of traditional payroll services.

Plans of Gusto

Gusto provides three plans: Simple, Plus, and Premium.

- Simple: With this Gusto plan, companies can experience seamless payroll processing with automated features and integrated benefits, all available at $40 per month, plus an additional $6 per person.

- Plus: With this plan, companies can unlock a comprehensive suite of payroll, benefits, and HR tools, empowering employers to create an exceptional work environment, whether in-person or remote. This plan is available at $80/mo plus an additional $12/mo per person.

- Premium: This offers scalable payroll and benefits, expert HR services, priority support, and a dedicated success liaison to cater to the intricate needs of growing teams. This comprehensive package ensures that businesses can seamlessly manage their expanding workforce with confidence and efficiency.

Here are the key features of Gusto:

1. All-in-One Solution for Payroll and HR:

- Benefits administration: Simplify offering health insurance, retirement plans, and more.

- Hiring and onboarding: Streamline the new hire process with tools like digital I-9s and offer letter templates.

- Time tracking and project management: Track employee hours and project costs efficiently.

- Employee self-service portal: Empower employees to manage their data and access pay stubs anytime.

- Performance reviews: Conduct and manage performance reviews directly within the platform.

2. Automation and Time-Saving Features:

- Payroll on AutoPilot®: Automate payroll processing with tax calculations and filings.

- 2-day and 4-day direct deposit: Offer faster access to wages for employees.

- Next-day direct deposit (additional fee): Provide the fastest possible access to earned pay.

- Digital paystubs with lifetime access: Eliminate paper waste and provide easy access to past pay stubs.

- Garnishments: Automate deductions for child support, student loans, etc.

3. Scalability and Compliance:

- Multi-state payroll: Manage payroll seamlessly across different states.

- International contractor payments: Pay international contractors easily and securely.

- State tax registration: Get registered for payroll taxes in all 50 states.

- Tax filings and payments: Ensure accurate and timely filings with automated assistance.

- ACA, HIPAA, ERISA compliance: Stay compliant with complex HR regulations.

4. Employee-Centric Features:

- Gusto Wallet employee app: Access pay stubs, manage spending, and receive early direct deposit (additional fee).

- 401(k) retirement savings: Offer employees a convenient way to save for retirement.

- Health insurance administration: Simplify enrolling and managing health insurance options.

- Paid time off (PTO) policies and holiday pay: Manage PTO accruals, requests, and holiday schedules.

- Time off calendar syncing: Integrate PTO with personal calendars for better work-life balance.

5. Dedicated Support and Guidance:

- Full, priority, and dedicated support: Choose the level of support that best fits your needs.

- 24/7 Help Center access: Get answers to your questions anytime, anywhere.

- Licensed benefits advisors: Access expert guidance on complex HR issues.

- Direct access to certified HR experts: Receive personalized support from HR professionals.

Pros of Gusto:

- A User-friendly interface makes navigating payroll a breeze.

- Excellent customer support to answer your questions promptly.

- Integrates seamlessly with various HR and accounting platforms for unified data management.

Cons of Gusto:

- Pricing might be higher compared to some competitors.

Gusto payroll software is highly recommended for businesses seeking scalable payroll solutions that can adapt as they grow. It is an excellent choice for those who prefer time-tracking options seamlessly integrated with full-service payroll. Additionally, Gusto caters to employers looking for flexibility with multiple direct deposit options.

Unlock Efficiency: Watch the Demo Video of Gusto Payroll in Action

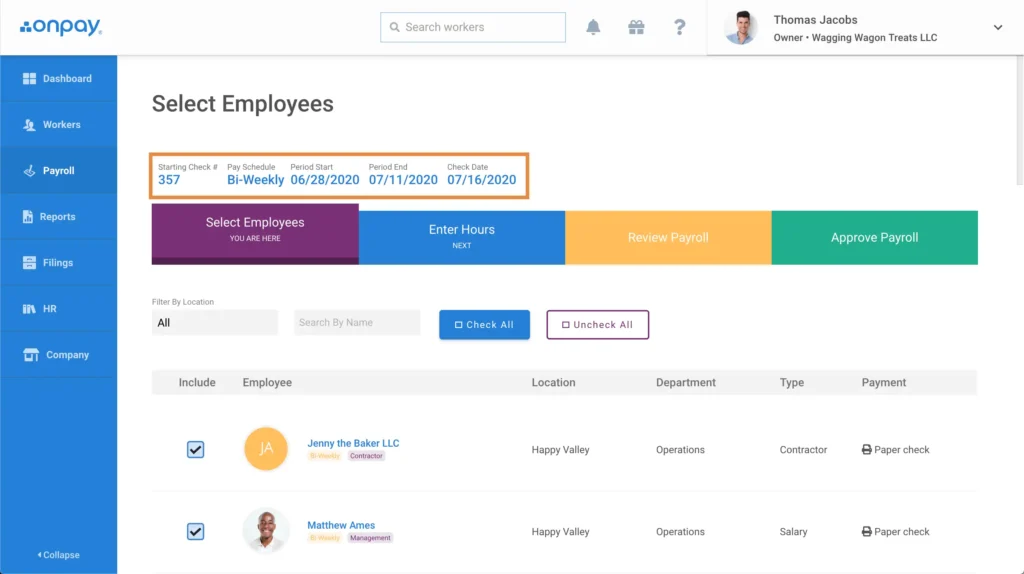

2. OnPay: Industry-Specific Expertise at Your Fingertips

Tailored to meet the distinct requirements of diverse industries, this payroll software stands out for its industry-specific features and seamless integrations. OnPay provides an efficient payroll solution designed to address the unique needs of various sectors.

Plan of OnPay:

OnPay simplifies your payroll management with a single comprehensive plan. Priced at $40 per month plus $6 per employee, you get the added benefit of a free first month. This full-service payroll plan offers unlimited pay runs, automated tax payments, and filings.

Here are the key features of OnPay:

- Comprehensive Tax Management: OnPay efficiently handles federal, state, and local payroll taxes. It not only withholds these taxes but also sends the payments and files 940 and 941 forms. Multi-state payroll is seamlessly accommodated without additional costs.

- Garnishment Deductions Made Easy: OnPay simplifies the process of deducting garnishments with just two clicks, ensuring a hassle-free experience for employers.

- Unemployment Insurance Management: The platform withholds state and federal unemployment insurance payments and manages employer contributions, providing a complete solution for unemployment insurance.

- Employee Self-Service Portal: OnPay offers an employee self-service portal, granting lifetime access to paystubs and tax documents. This empowers employees with convenient and secure access to their essential information.

- Integration Capabilities: OnPay integrates smoothly with various platforms, including QuickBooks Online, Xero, and several HR and time-tracking tools. The vendor actively assists in setting up these integrations, enhancing overall efficiency.

- Diverse Customer Support: OnPay provides customer support through phone, chat, and email, ensuring that users can reach out in their preferred mode for assistance.

- Basic HR Features: OnPay goes beyond payroll with basic HR capabilities. This includes e-signatures, online I9 and W2 forms, and direct messaging tools for HR conversations. The latter is particularly useful for maintaining audit trails.

- Organization Charts: The platform offers organization charts, allowing businesses to classify workers based on location, team, or department. This feature enhances organizational clarity and structure.

- Access to Insurance Policies: OnPay facilitates access to 401(k), health, and life insurance policies through partnerships with reputable providers and in-house brokers. This makes it a convenient hub for various employee benefits.

Pros of OnPay:

- Deep understanding of your industry’s payroll challenges and complexities.

- Competitive pricing with features geared towards your specific needs.

- Dedicated account managers for personalized support.

Cons of OnPay:

- The user interface might feel less intuitive compared to some competitors.

OnPay payroll software comes highly recommended for small and mid-sized companies. It is an ideal choice for businesses that specifically require full-service payroll along with a few additional HR features. OnPay caters to those who prefer a straightforward approach, as it doesn’t require upgrading plans to access essential features.

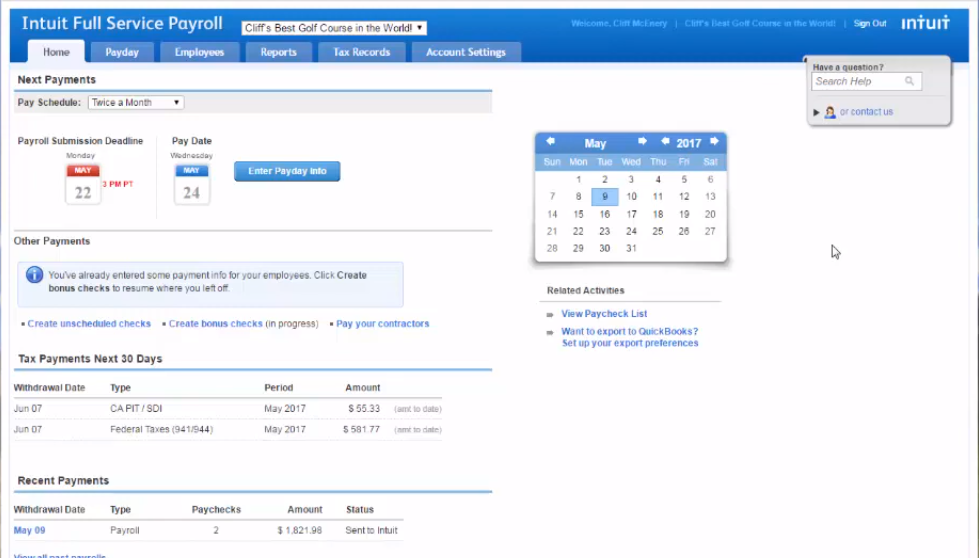

3. Intuit QuickBooks Payroll: Familiarity and Affordability, Hand in Hand

Tailored for small businesses already utilizing QuickBooks accounting software, this payroll solution offers an affordable and seamlessly integrated option, streamlining financial processes for enhanced efficiency.

Plans of Intuit QuickBooks Payroll:

Existing QuickBooks Online users can easily add payroll to their plan. New users have different options to choose from based on their needs. The basic Payroll Core plan costs $45 plus $5 per employee per month. For an extra $30, users can get payroll with QuickBooks Simple Start.

If you’re more focused on contractor payments, there’s a plan for unlimited 1099 e-filing and free next-day payments. The $15 base fee covers 20 contractors, and freelancers can set up a free account for tax forms and banking details. Additionally, users can include accounting software with the contractor-only plan for an additional $30 per month.

Here are the key features of Intuit QuickBooks Payroll software:

- Calculates payroll taxes accurately.

- Manages filing and payment of state and federal taxes on behalf of the user.

- Allows business owners to effortlessly create 1099s within the platform.

- Basic payroll processing with automatic calculations and tax filing assistance.

- Time tracking functionalities to manage employee hours.

- E-filing 1099s feature which comes with an additional fee.

Pros of Intuit QuickBooks Payroll:

- Seamless integration with QuickBooks accounting software for unified data management.

- Affordable pricing for basic payroll needs.

- Simple and familiar interface for QuickBooks users.

Cons of Intuit QuickBooks Payroll:

- Limited features compared to competitors, making it unsuitable for complex payroll needs.

Intuit QuickBooks payroll software comes highly recommended for small to medium-sized businesses, offering an ideal solution for those looking to seamlessly integrate accounting software with payroll management. This platform is particularly well-suited for individuals and businesses who prioritize the convenience of automatic filing for both federal and state taxes.

Choosing Wisely: Take into Account These Essential Factors:

- Company size and complexity: Are you a small business with basic needs or a larger organization requiring advanced features?

- Industry-specific needs: Does your industry have specific compliance requirements or integrations needed?

- Features and functionality: What features are essential for you, such as time tracking, benefits administration, or robust reporting?

- Budget: What are you willing to spend on payroll software per month or per employee?

- User-friendliness: How comfortable are you and your employees with learning new software?

- Customer support: What level of support do you need from your payroll provider?

Always bear in mind that the best payroll software is the one that impeccably aligns with your distinct needs and budget. Take the time to assess your priorities, thoroughly compare these top contenders, and feel free to delve into demos and utilize free trials to make an informed decision that perfectly suits your requirements.

Conclusion

In the realm of payroll management, the choice between Gusto, OnPay, and Intuit QuickBooks Payroll software ultimately boils down to the distinct requirements of your business. As we conclude this exploration, it’s crucial to emphasize that the perfect payroll software is the one that seamlessly aligns with your company’s size, industry-specific demands, budget constraints, and desired features. Be it the comprehensive HR solutions of Gusto, the industry-specific expertise of OnPay, or the familiarity and affordability of Intuit QuickBooks Payroll, each option has its merits. Take the time to assess your priorities, explore demos, and leverage free trials, ensuring that your chosen solution not only meets but exceeds your expectations. With the right payroll software in place, you can propel your business forward with efficiency, accuracy, and peace of mind.