Payroll management is a critical component of any business operation. As you are aware, it encompasses tasks such as calculating employee salaries, tax deductions, bonuses, overtime payment calculations and various other financial elements. In the past, this was typically done manually, often on paper, which not only consumed a significant amount of time but was also highly susceptible to errors.

Subsequently, companies began utilizing Excel for payroll-related processes. However, in recent times, the emergence of specialized payroll processing software has transformed the landscape for businesses.

In this blog, we will explore the common software solutions used for payroll processing.

Below, you’ll find a list of popular payroll software solutions designed to streamline payroll processing, making it more efficient, quicker, and virtually error-free.

The most common payroll software solutions are:

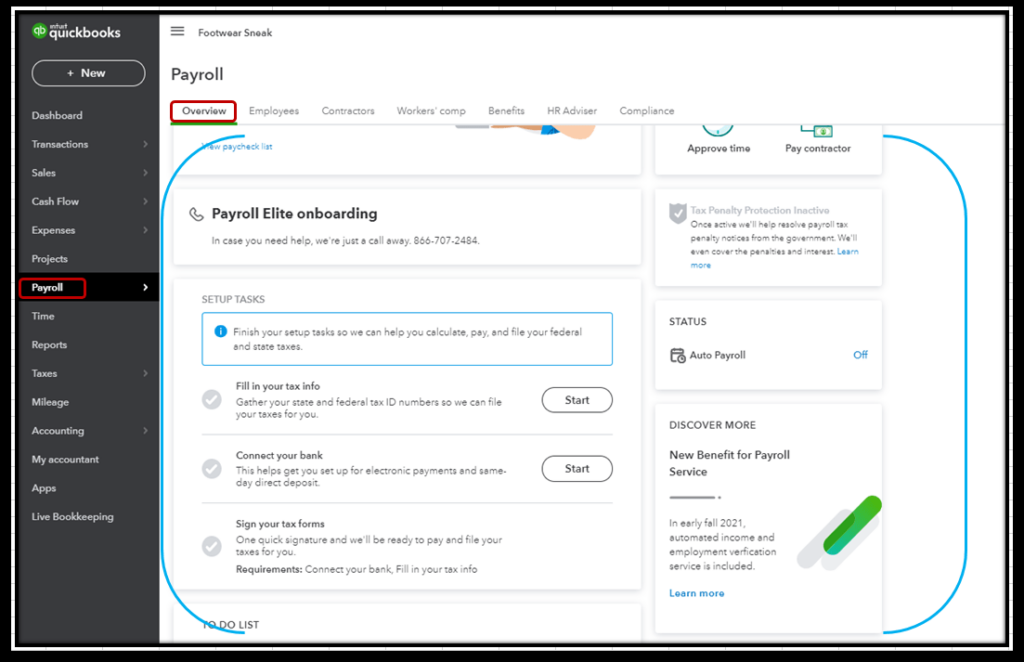

1. QuickBooks Payroll: It is a prominent name in the realm of accounting software, and shines as a formidable choice for efficient payroll management. This robust solution effortlessly handles complex payroll calculations, simplifies tax filings, and offers the added convenience of direct deposit for your dedicated workforce. QuickBooks Payroll is tailor-made for the requirements of small and medium-sized enterprises. As of 2023, QuickBooks Payroll proudly serves a user base exceeding 4 million, solidifying its position as the most widely adopted and prevalent payroll software globally.

2. ADP Workforce Now: In the realm of HR and payroll solutions, ADP stands as a heavyweight champion, catering to businesses of diverse sizes and structures. Their cloud-based platform, ADP Workforce Now, serves as an all-inclusive hub adept at seamlessly managing payroll, HR tasks, time and attendance, as well as benefits administration. This versatile and scalable solution is tailor-made for businesses experiencing rapid growth. With a user base exceeding 3 million, ADP Workforce Now firmly secures its position as the second most prevalent software for payroll.

3. Paychex Flex: It is a cloud-based payroll and HR solution, tailor-made for the unique needs of small businesses. Its feature-rich offering encompasses online payroll processing, streamlined tax filing, efficient time and attendance tracking, and comprehensive benefits administration. What sets Paychex Flex apart is not only its feature set but also its user-friendly interface and robust customer support. By 2023, it has successfully garnered a user base exceeding 2 million, solidifying its position as the third most widely adopted payroll software on a global scale.

4. Gusto: It is the go-to payroll software for small businesses seeking simplicity without sacrificing power. It’s the ultimate payroll companion, automating those pesky tax calculations, effortlessly generating pay stubs, and delivering a suite of HR features. Gusto’s interface is a breeze to navigate, making payroll management a walk in the park for business owners. Gusto currently boasts over 1 million users, securing its position as the fourth most commonly used payroll software. Despite being a relatively new entrant compared to the two aforementioned software, it is experiencing rapid growth.

5. OnPay: Tailored for small businesses, OnPay is a cloud-based payroll software renowned for its affordability and versatility. It boasts a comprehensive feature set, encompassing online payroll processing, tax filing, direct deposit, and employee self-service. OnPay stands out with its seamless integration capabilities, harmonizing with various other essential business software. As of 2023, OnPay boasts an impressive user base, exceeding 1 million users.

Conclusion

Payroll management is a fundamental aspect of business operations that demands precision and efficiency. Gone are the days of manual calculations and Excel spreadsheets, thanks to the advent of specialized payroll software. The common software solutions discussed here—QuickBooks Payroll, ADP Workforce Now, Paychex Flex, Gusto, and OnPay—have revolutionized how businesses manage their payroll processes. With millions of users collectively relying on these solutions, it’s clear that they have become integral tools in ensuring accurate, swift, and error-free payroll management. As businesses continue to evolve, embracing these payroll software solutions has proven to be a strategic step towards streamlined operations and employee satisfaction