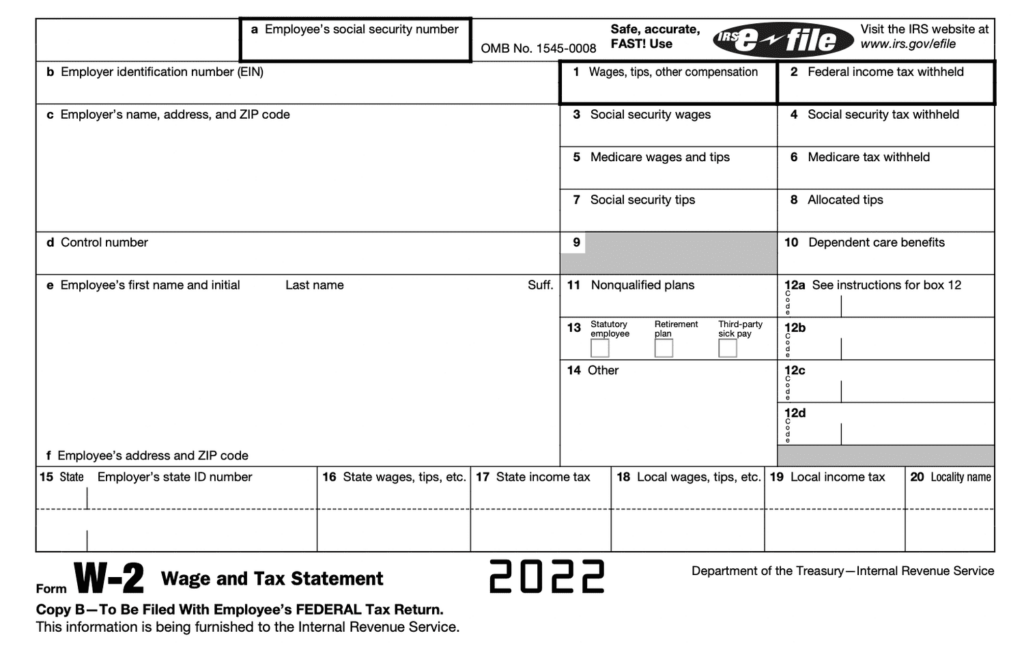

In today’s technology-driven world, electronic filing has become the standard for many important documents, including IRS tax forms. The IRS has recently implemented new electronic filing requirements for one of the most commonly used forms, the W-2. This form is used by employers to report wages, tips, and other compensation paid to their employees.

With the new electronic filing requirements, employers must submit their W-2 forms through the SSA’s BSO system or the IRS’s FIRE system. These changes were made to improve efficiency, accuracy, and security in the processing of tax data.

Below are the new electronic filing requirements for Forms W-2:

Increased Security Measures For W-2s

As a response to the growing threats of identity theft and fraud, there have been significant advancements in the security measures surrounding W-2 forms. These measures aim to safeguard the confidential data contained within these forms, such as social security numbers and income details. Employers are now mandated to implement stronger encryption protocols and secure transmission methods when electronically filing W-2 forms. By doing so, they mitigate the risk of unauthorized access or interception during the transmission process.

The Deadline For Electronic Filing Extended

In response to the evolving landscape of electronic filing and the need for employers to adapt to new regulations, the deadline for electronic filing of Forms W-2 has been extended. This extension allows employers additional time to ensure compliance with the new electronic filing requirements and implement the necessary security measures to protect sensitive employee information.

By extending the deadline, employers have the opportunity to thoroughly review their electronic filing processes and make any necessary adjustments to ensure accuracy and security. This extension demonstrates the commitment of regulatory bodies to supporting employers in their efforts to transition to electronic filing while prioritizing the security and privacy of employee data.

Penalties For Non-Compliance Updated

Failure to comply with these new regulations can result in significant financial consequences. The penalties for non-compliance have been adjusted to ensure strict adherence to the electronic filing guidelines. Employers who fail to file Forms W-2 electronically or submit inaccurate or incomplete information may face penalties ranging from financial fines to potential legal actions.

These updated penalties underscore the importance of understanding and meeting the new electronic filing requirements to avoid any potential repercussions. Employers should take the necessary steps to familiarize themselves with the updated penalties and ensure full compliance with the regulations to mitigate any risks associated with non-compliance.

Options For Filing Extensions Are Available

The IRS recognizes that circumstances may arise where employers need additional time to gather and submit accurate information. In such cases, employers can request an extension by filing Form 8809, Application for Extension of Time to File Information Returns. This form allows employers to extend the deadline for filing Forms W-2 by up to 30 days.

It is important to note that this extension only applies to the filing of the forms and not the distribution of copies to employees. Employers must still timely provide copies of Forms W-2 to their employees.

Understanding The New Submission Process

Employers are now required to submit Forms W-2 electronically, either through the SSA’s BSO website or through an approved third-party vendor. This transition from paper-based submissions aims to streamline the reporting process and enhance accuracy.

To initiate the submission, employers must ensure they have registered for an Employer Identification Number (EIN) and have established an account on the BSO website. Once the necessary preparations are in place, employers can proceed with the electronic submission, carefully reviewing and accurately inputting the required information for each employee.

Final Words

The new electronic filing requirements for Forms W-2 aim to streamline the filing process for both employers and the IRS. While the changes may initially seem daunting, they ultimately serve to improve accuracy and efficiency in tax reporting. Employers need to familiarize themselves with the new requirements and ensure timely and accurate filing to avoid any penalties.