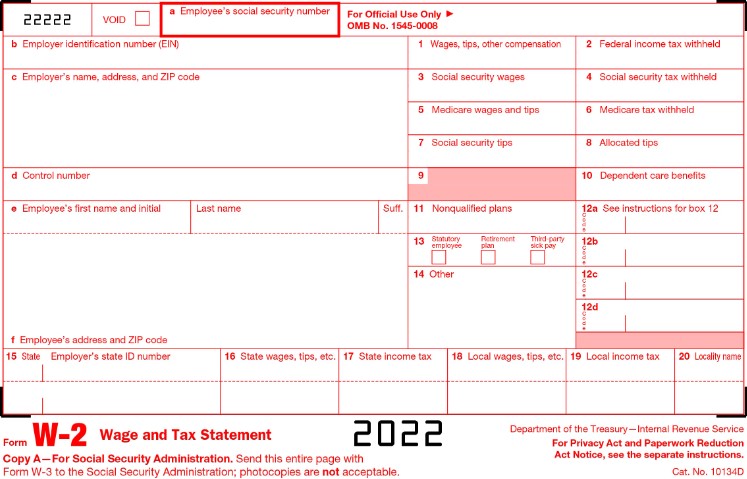

As the tax season approaches, employers are faced with numerous requests for Form W-2, the Wage and Tax Statement. While providing this document is a standard practice, what should employers do when they receive duplicate requests for the same form? It can be a frustrating and time-consuming task to handle multiple requests for the same information, especially if it involves charging fees. However, it is crucial to handle these situations with professionalism and by the laws and regulations set by the IRS.

Here are some tips that employers can use to effectively handle duplicate requests for Form W-2, including the option of charging fees.

Understand The Legal Requirements First

Compliance with federal and state regulations is of utmost importance to avoid any potential legal issues or penalties. Familiarize yourself with the guidelines set forth by the IRS, including the rules regarding the disclosure and distribution of employee wage and tax information. Additionally, ensure that you are aware of any state-specific laws that may apply to your organization.

Communicate With The Employee Promptly

When faced with a duplicate request for Form W-2, prompt communication with the employee is essential. Once you have received the request, take immediate action to acknowledge it and inform the employee that their request is being addressed.

This proactive approach demonstrates your commitment to resolving the issue promptly and provides reassurance to the employee that their concerns are being taken seriously. Keep the lines of communication open throughout the process, providing updates on the status of their request and any necessary steps they need to take.

Outline The Process For Duplicate Requests

Begin by creating a dedicated channel for employees to submit their duplicate requests, such as an online form or designated email address. Communicate the required information that employees should include in their request, such as their full name, employee identification number, and the tax year for which the duplicate Form W-2 is needed. Once a request is received, assign it to a designated staff member responsible for handling duplicate requests. They should verify the employee’s identity and review the records to ensure that a duplicate Form W-2 is indeed necessary.

If the request is valid, the staff member should initiate the process of generating the duplicate Form W-2, ensuring that it contains accurate and up-to-date information. Upon completion, the duplicate Form W-2 should be securely delivered to the employee, keeping in mind any applicable privacy and data protection regulations.

Consider Charging A Reasonable Fee

Charging a fee can help cover the administrative costs associated with generating and delivering duplicate forms. However, it is crucial to ensure that the fee is fair and reasonable, taking into account the time and resources required to fulfill the request.

It is recommended to conduct a cost analysis to determine an appropriate fee structure, considering factors such as staff time, materials, and postage expenses. Communicate this fee policy to employees, providing transparency and clarity regarding the charges involved.

Keep Accurate Records For Audit

Maintaining detailed and organized documentation of each request, including the date, requester’s information, and specific details of the duplicate form provided, is crucial. These records will serve as a reliable reference point in the event of an audit, allowing for swift verification of the organization’s adherence to applicable policies and procedures. Implementing a secure digital system or utilizing a designated folder for storing these records can streamline the process and facilitate easy access when required.

Final Words

It is important for organizations to have clear policies in place for handling duplicate requests for Form W-2 and to communicate these policies to employees. Charging fees may be necessary in some cases to cover administrative costs, but it is important to consider the potential impact on employees and the overall reputation of the company.