In the dynamic landscape of contemporary work, the gig economy has emerged as a transformative force, providing flexibility and diverse opportunities for both workers and employers. This surge is primarily attributed to three key factors: the global pandemic, the evolving employment preferences of the new generation, and the cost-effectiveness inherent in gig-based arrangements. However, within this evolving ecosystem, mastering the intricacies of payroll poses distinct challenges for employers.

In this blog, we will delve into the top five common payroll challenges encountered by employers in the gig economy and explore potential strategies to effectively address them.

Freelancer working from home

1. Variable Work Hours and Payments:

A cornerstone of the gig economy is the autonomy it grants workers to set their own schedules, a significant advantage for independent contractors. However, this flexibility presents a challenge for employers in accurately calculating payroll. Failure to address this challenge can lead to payment inaccuracies and potential dissatisfaction among gig workers.

To tackle this challenge effectively, consider the implementation of automated time-tracking tools. These tools play a crucial role in streamlining the payroll process, offering both transparency and accuracy in payment calculations.

2. Classification of Workers

In the dynamic landscape of the gig economy, workers assume diverse roles such as freelancers, independent contractors, or part-time employees, each entailing distinct legal considerations. Employers must adeptly navigate the intricacies of worker classification to adhere to labor laws and tax regulations. Accurate classification is paramount, as missteps in this process can result in legal ramifications and financial penalties for employers.

To address this challenge effectively, employers should maintain a keen awareness of the nuanced differences between various worker classifications. Additionally, leveraging advanced payroll software that is designed to accommodate the complexities of diverse employment scenarios proves instrumental. This approach ensures accurate and compliant payroll processing, allowing employers to navigate the intricate landscape of worker classifications with efficiency and precision.

3. Compliance with Tax Regulations

In the gig economy, ensuring tax compliance becomes increasingly complex as workers operate across diverse jurisdictions. Employers grapple with the challenge of navigating the intricacies of withholding and remitting taxes for a workforce spread across various geographical locations. Neglecting these challenges can lead to legal complications, financial penalties, and strain the employer-employee relationship.

To address this challenge and maintain compliance with tax regulations, it is imperative to have a robust payroll system equipped with automation for tax-related processes. Employers should consider seeking professional advice and leveraging technology as crucial strategies to effectively navigate the intricate landscape of tax compliance in the gig economy.

4. Integration of Multiple Payment Methods

In the dynamic landscape of the gig economy, gig workers showcase a broad spectrum of payment preferences, including traditional direct deposits, digital wallets, and even cryptocurrency. For instance, some gig workers may prefer the speed and convenience of digital wallets, while others may lean towards the familiarity of traditional direct deposits. In contrast, a niche segment might opt for the innovation of cryptocurrency payments. Juggling these preferences manually can lead to errors, delays, and an overall inefficient payment process.

This diversity in choices can present a challenge for conventional payroll systems, which may struggle to adapt to such varied payment methods seamlessly.

To address this challenge, employers need to first understand the diverse preferences of gig workers. They should initiate payments through various methods and seek payroll solutions capable of seamlessly integrating and managing multiple payment channels. This adaptability contributes to smoother transactions, reduces errors, and enhances overall satisfaction among gig workers, fostering a positive employer-employee relationship.

5. Data Security and Confidentiality

In the dynamic landscape of the gig economy, digital technology and platforms play a pivotal role not only in facilitating work but also in the intricate process of payment processing. However, this extensive reliance on technology comes with its own set of challenges, particularly in exposing valuable information to potential cybersecurity threats. Safeguarding crucial data, from work-related information to payroll details, becomes imperative in the face of these challenges.

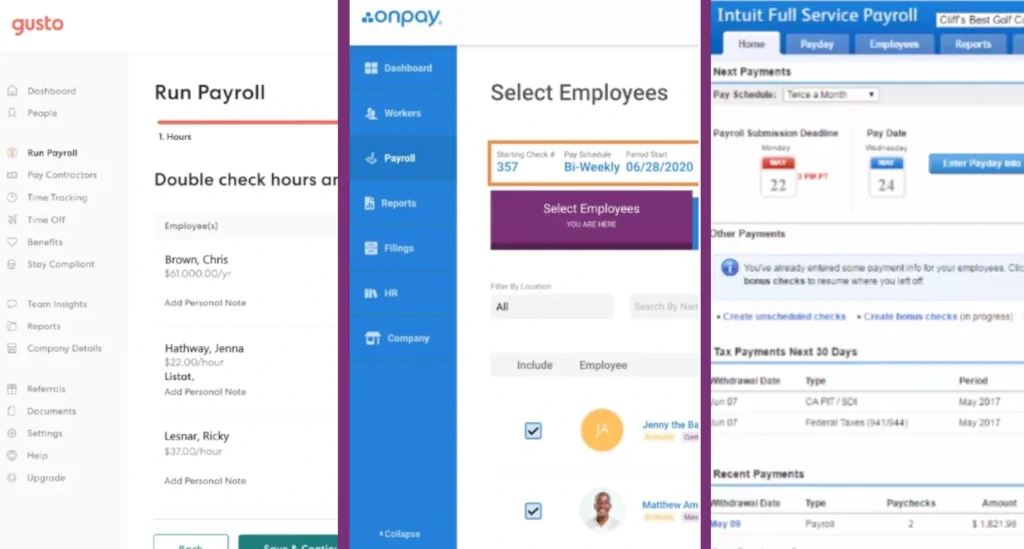

Payroll software

To navigate this challenge successfully, employers must prioritize the security and confidentiality of payroll data. This involves using the best payroll software implementing robust cybersecurity measures and ensuring strict compliance with data protection regulations. Conducting regular audits and staying vigilant with updates to security protocols are essential practices. By adhering to these measures, employers can effectively safeguard sensitive payroll and other information, mitigating the risks of unauthorized access and potential breaches.

Conclusion

In wrapping up, the gig economy offers exciting possibilities but comes with unique payroll challenges. By using tools like automated time-tracking, advanced payroll software, consulting and taking the help of experts, and prioritizing data security, employers can overcome these hurdles. Adapting to gig workers’ preferences not only streamlines payments but also strengthens the employer-worker relationship. Navigating this landscape requires staying informed and embracing innovation. In simplifying payroll complexities, employers not only meet the demands of the gig economy but also create a thriving work environment for all.